Overall this XM review found that the broker is recognized as a reliable and secure broker, boasting a commendable trust score of 93 out of 99. It caters well to both novice and experienced traders, offering a low minimum deposit requirement and comprehensive educational resources. With 24/5 customer support and an intuitive copy trading feature, XM ensures a user-friendly experience for its clients.

If you're considering trading with XM broker, it's important to do your research and understand the benefits and drawbacks of this popular broker. In this comprehensive XM broker review, we'll take a closer look at the broker's features, fees, and customer support to help you make an informed decision about whether it's the right choice for your trading needs.

What Is XM? (XM Group)

XM is an internationally regulated and licensed broker with more than 10 million clients in over 200 countries with access to trading more than 1,000 instruments. With XM Group, traders can choose between the popular MetaTrader 4 or MetaTrader 5 platforms or access the XM WebTrader through their browser.

XM was founded in 2009 and the broker has picked up over 30+ industry awards. This XM broker review found that XM offers an advanced platform for trading and flexible trading conditions to suit a wide range of global customers. XM’s expertise originates from the in-depth knowledge derived from its experience in the worldwide financial & forex markets.

XM Broker 2024 Overview

| 🔎Broker's Name | XM.com |

| 🏚 Headquarters | UK |

| 📅 Year Founded | 2009 |

| ⚖ Regulating Authorities | FCA, IFSC, CySec, ASIC |

| 🧾Account Types | Micro Account; Standard account; Ultra Low Account; Shares Account |

| 🎁 Bonus | Yes, $30 |

| 🧪 Demo Account | Yes |

| 💸 Fees | $3.50 |

| 💸 Spreads | spreads from 0.6 to 1.7 pips |

| 💸 Commission | commission-free trading depending on the account selected |

| 🏋️♀️ Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit | $5 or equivalent |

| 💳 Deposit & Withdrawal Options | Bank Wire Transfer , Local Bank Transfer, Credit/Debit Cards, Neteller, Skrill, and more. |

| 📱 Platforms | MT4 and MT5 |

| 🖥 OS Compatibility | Web browsers, Windows, MacOS, Linux, Android, iPhone, tablets, iPads |

| 📊 Tradable assets offered | Forex, commodities, cryptocurrency, shares, indices, metals, energies, options, bonds, CFDs, and ETFs |

| 💬 Customer Support & Website Languages | 27 Languages |

| ⌚ Customer Service Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

XM Account Types 2024

This XM broker review found that there are a variety of account types offered by the broker.

XM Micro Account

The XM Micro account users gain access to trading in USD, GBP, EUR, AUD, CHF, HUF, JPY, and PLN currencies. The base currency trading in this account starts with a minimum deposit of $5. There are 1,000 units of the base currency in one Micro lot. The maximum leverage on this account is 1:1000. The account comes with negative balance protection and up to 300 open positions/pending orders. Spreads are as low as 1 pip and it offers commission-free trading.

2. XM Standard Account

The base currencies for an XM Standard account include AUD, USD, GBP, CHF, EUR, JPY, PLN, and HUF. The minimum deposit for this account Is $5. There are 100,000 units of the base currency in one Standard lot. This account allows hedging and it also has negative balance protection.

Learn more about the XM Standard Account3 XM Ultra Low Standard Account

The Ultra Low Micro/Ultra Low Standard account offers swap-free trading for a wide selection of popular instruments such as Gold, EURUSD, USDJPY, EURJPY, GBPUSD and many others. Spreads on major pairs as low as 0.6 pips and the account has zero commissions and swaps. There are 100,000 units of the base currency in One Standard Ultra lot and 1,000 units of the base currency in One Micro Ultra lot.

Learn more about the XM Ultra Account4. XM Shares Account

This account requires a minimum deposit of $10,000, with the base currency limited to USD. Each contract size is equivalent to 1 share, and there is no leverage available. Spread values align with the underlying exchange rates.

Commission charges vary between $1 and $9 based on both the specific exchange and the individual share being traded. Clients are limited to a maximum of 50 open and/or pending orders. The minimum trade volume permitted is one lot, with lot restrictions varying for each share. Hedging is prohibited on this account.

Learn more about the XM Shares AccountXM Broker Review: How To Open An XM Real Trading Account in 2024

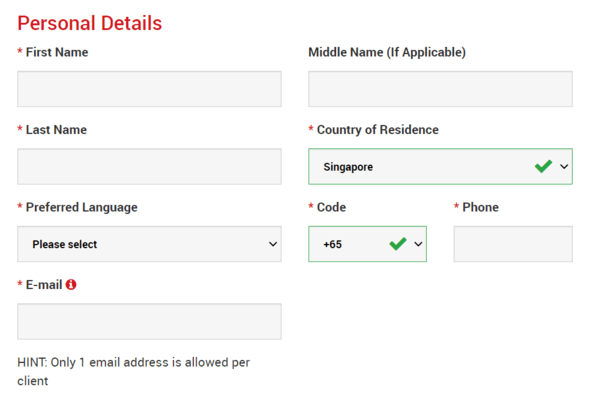

This XM broker review found that the account opening procedure is simple and it may take only 2 minutes to complete the online registration with XM. Follow the steps below.

1. Go to the XM Real Account Registration Page

Click on the green button that says ”Ópen an account” to access the XM broker portal, where you can find the application form to fill in.

2. Fill in the Registration Form

Fill in the form using your real details. Make sure you will be able to verify these details later as this is necessary for withdrawals. If you use fake details you will not be able to verify your account and you will not be able to withdraw from XM

3. Choose the Trading Platform & Account Type

XM Group offers both MT4 and MT5 so you must choose your preferred platform first. Then you must choose the account type you want from the ones offered by XM. After registration, you can also open multiple trading accounts of different account types. Over the next pages, you must read and agree to the terms and conditions and fill in further personal details.

You will also get the chance to set up your account password. Make sure you use a password that you can easily remember so that you will not be locked out of your account.

Click on the ‘Open Real Account‘ button to proceed.

4. Confirm Your Email & Account

You will then get an email from XM Group asking you to confirm your email address. Press where it says “Confirm email address“. After confirming your email address new browser tab will open with welcome information.

The identification or user number that you can use on the MT4 or Webtrader platform is also provided. You will also get an email with the XM real account login credentials.

You can then log in and start trading as you would have finished the XM real account registration.

How To Verify Your XM Real Account

You can begin trading on XM without verifying your account but you will face limitations and deposit limits. Fortunately, this XM broker review found that verifying your XM account is easy.

You only need to upload your ID if you are based in your country of birth. You do not need to upload proof of residence as long as you are in your home country.

Make sure you have a clear picture of both the front and back of your identity document.

To verify your XM live account do the following:

- Log into your XM account and access the members area.

- Locate the account verification section: It will be titled “Upload Documents“. Click on it.

- Upload your identity document which can be a color copy of valid passport, driver’s license, identity card etc

- Wait for verification: You will get confirmation that your documents have been uploaded successfully. XM usually verifies accounts in 24 hours. You will get an email confirming that your account has been verified and all the account restrictions will be lifted.

XM Broker Deposit & Withdrawal Review

This XM Group review found that the broker offers a variety of deposit and withdrawal methods for traders. These methods include Credit cards, Debit cards, Neteller, Skrill, UnionPay, Web money, and Bank Wire. The minimum deposit and withdrawal at XM is $5 depending on the method used.

XM Group allows deposits to be made in any currency. However, they will be automatically converted into the base currency that the client chose when they opened the account.

How long does it take to withdraw from XM?

The back office processes XM broker withdrawal requests within 24 hours. You will receive your money on the same day for payments made via e-wallet, while for payments by bank wire or credit/debit card it usually takes 2 – 5 business days.

From my experience withdrawals made via e-wallet usually reflect within two hours or less.

XM Minimum Deposit

All XM accounts have a minimum deposit of $5 except the XM shares account which has a minimum deposit of $10 000. This makes the broker very convenient and accessible.

How Do You Deposit Money on XM Broker

To deposit in your XM real trading account, please do the following steps:

- Login to the XM Member account.

- Select the deposit method such as Credit card, Bank Wire, or some wallet method.

- Type in the cell the deposit amount.

- Confirm the account number and deposit amount.

- Make payment.

How Long Does It Take For Deposits to Reflect on XM?

Deposits made to XM typically reflect in your account almost instantly. However, the exact time may vary depending on the payment method used. Generally, deposits via electronic payment methods such as credit/debit cards, e-wallets, and bank transfers are processed swiftly.

Once the deposit is successfully processed, you should see the funds available in your XM trading account without significant delay.

XM Bonus Review

XM is known for offering a range of bonuses and promotions to its clients. These bonuses can be a great way for traders to boost their trading capital and take advantage of additional trading opportunities. In this section, we will take a closer look at the bonuses and promotions offered by XM.

$30 No Deposit Bonus

The $30 no-deposit bonus is available to new clients who sign up for an account with XM Group. The bonus is credited to the client's account as soon as the account is verified, and it can be used to trade on the platform.

The bonus is available for 90 days, during which time the client can use it to trade on any of the financial instruments offered by XM.

One of the main benefits of the $30 no deposit bonus is that it allows new clients to trade on the platform without risking any of their own money.

This is a great way for new traders to get a feel for the platform and to test out their trading strategies without any financial risk.

However, clients should be aware of the limitations of the bonus, including the limited timeframe, withdrawal restrictions, and limited profit potential.

This comprehensive guide explains all you need to know about the XM $30 no deposit bonus.

XM Deposit Bonus

XM Group offers deposit bonuses to its clients as a way to reward them for their loyalty and encourage them to trade more. These bonuses are based on the client's deposit amount and can range from 10% to 100% of the deposit amount.

The bonus is credited to the client's account as soon as the deposit is made, and it can be used to trade on the platform.

One of the main benefits of deposit bonuses is that they can boost the client's trading capital and allow them to take advantage of additional trading opportunities.

The deposit bonuses offered by XM are subject to terms and conditions, which clients should be aware of before accepting the bonus. These terms and conditions can include trading volume requirements, which means that the client needs to trade a certain number of lots before they can withdraw the bonus.

The trading volume requirements can vary depending on the bonus amount and the client's account type.

It is important to note that deposit bonuses are not free money, and clients should not view them as such.

The bonus is intended to be used as trading capital, and clients should use it to take advantage of additional trading opportunities.

XM Leverage

XM offers leverage of up to 1:1000 for forex trading on all its accounts except the shares account which has no leverage. The amount of equity in the account also determines the leverage level as shown in the table below.

| 📈 Leverage | 📌 Total Equity |

| 1:1 to 1:1000 | $5 – $20,000 |

| 1:1 to 1:200 | $20,001 – $100,000 |

| 1:1 to 1:100 | $100,001 + |

XM Fees

XM Broker offers a transparent and competitive fee structure that is based on the account type, trading instrument, and trade volume. Here is a breakdown of the fees on XM Broker:

- Spreads: XM Broker offers two account types that charge a spread: Micro and Standard. For Micro and Standard accounts, the starting spread for major currency pairs is 1 pip.

- Commission Fees: XM Broker offers one account type (XM Global shares account) that charges a commission fee which varies with the type of share being traded and the underlying exchange.

- Inactivity Fee: An inactivity fee of $5 per month is charged for accounts that have been inactive for 90 days or more. To avoid this fee, the trader must make at least one trade or make a deposit within the 90-day period.

- Overnight Financing Fees: If you hold a position overnight, you will be charged a small fee (also known as a swap or rollover fee). The fee amount varies depending on the trading instrument and the direction of the trade.

- Deposit and Withdrawal Fees: XM Broker supports a range of deposit and withdrawal methods, including bank transfer, credit card, and electronic payment methods. While XM Broker does not charge fees on deposits, some payment methods may charge a fee. Withdrawal fees vary based on the withdrawal method.

Overall, XM Broker's fees are competitive and transparent. The spreads and commission fees charged are reasonable and on par with industry standards. The inactivity fee is also standard across the industry, and the overnight swap fees are competitive with other brokers.

It is important to note that XM Broker follows a “no hidden fees or commissions” policy, which means that traders will not encounter any hidden fees while trading on the platform. Traders can calculate their trading costs in advance with the help of the fee calculation tools that XM Broker provides on their website.

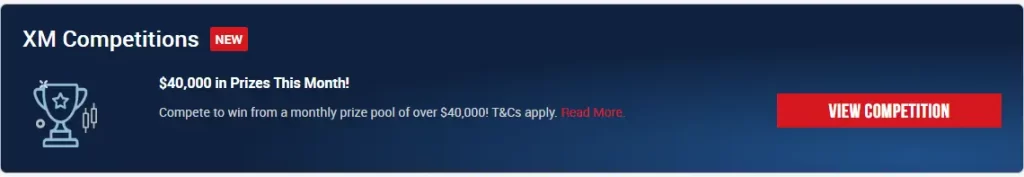

XM Competitions

XM offers monthly trading competitions on both real and demo accounts that give traders a chance to win withdrawable prizes. The competitions have no entry fees and you can compete in more than one competition at a time.

XM broker has several competitions including:

- The Seven-Day Showdown (Prize pool $10 000)

- The Daily Challenge (Prize Pool $5 000)

- The Five-Day Showdown (Prize Pool $30 000)

- The Funded Strategy Manager with different tiers (Prize Pool Tier 2 $20 000, Tier 1, $40 000)

- Top Performer with three tiers. (Prize Pool, Tier 3 $40 000, Tier 2 $20 000, Tier 1 $5 000)

These different XM competitions have different account types and equity requirements. You will be able to see these specific requirements when you register for each competition.

How To Enter The XM Competitions

These XM competitions are open to all XM clients with verified real accounts.

Click here to open your XM live account.

After creating the account verify it by simply uploading your identity document like your ID or passport. You do not need proof of residence to verify your account as long as you are based in your home country.

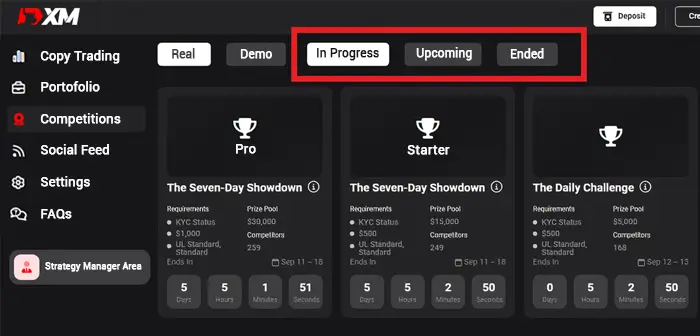

After verifying the account follow these steps to join the XM competition.

1. Log in to your XM account and look for the competitions tab.

2. Click on ‘View Competition‘ and you will be directed to the competition page. As shown in the picture below, you can view ongoing competitions (In Progress), upcoming ones, and those that have ended. You can also view the competition requirements.

There will also be a breakdown of the competition prizes.

3. Click “Upcoming” to register for the next competition because you won't be able to join once it's in progress.

4. You will then get a notification when the next competition is about to start and you can then join in.

XM Loyalty Program

XM's loyalty program is designed to reward clients for their trading activity and encourage them to trade more. With several levels, and clients can move up the levels by increasing their trading volume.

The loyalty program offers cashback and bonus rewards based on the client's trading volume.

The loyalty program has four levels: Executive, Gold, Diamond, and Elite. Clients are automatically enrolled in the loyalty program when they open an account with XM, and they start at the Executive level.

Clients can move up the levels by increasing their trading volume, and the rewards increase as the client moves up the levels.

The loyalty program offers cashback and bonus rewards based on the client's trading volume. The cashback rewards are paid out weekly and are based on the client's trading volume for the previous week.

The bonus rewards are credited to the client's account every month and are based on the client's trading volume for the previous month.

The cashback rewards and bonus rewards increase as the client moves up the levels.

xm trading platform review

XM offers several trading platforms to its clients, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are widely used in the industry and offer a wide range of features and tools for traders.

The platforms are available for desktop, web, and mobile devices, which means that clients can trade on the go.

MetaTrader 4 (MT4) is one of the most popular trading platforms in the industry and is widely used by traders around the world.

MT4 offers a wide range of features and tools, including advanced charting capabilities, a wide range of technical indicators, and the ability to automate trades using expert advisors (EAs).

MT4 also offers a user-friendly interface and is easy to navigate, which makes it a great option for both new and experienced traders.

MetaTrader 5 (MT5) is the successor to MT4 and offers even more features and tools for traders.

MT5 offers advanced charting capabilities, a wide range of technical indicators, and the ability to trade on multiple markets, including forex, stocks, and commodities.

MT5 also offers a built-in economic calendar and news feed, which can be a great way for traders to stay up-to-date on market events.

In addition to MT4 and MT5, XM also offers its own proprietary platform called XM WebTrader. This platform is web-based and does not require any downloads or installations.

XM WebTrader offers a user-friendly interface and a range of trading tools and features, including advanced charting capabilities, a wide range of technical indicators, and the ability to trade on multiple markets.

XM also offers mobile trading platforms for both iOS and Android devices through the XM App.

The mobile platforms offer a user-friendly interface and a range of trading tools and features, including advanced charting capabilities, a wide range of technical indicators, and the ability to trade on multiple markets.

The mobile platforms also offer push notifications and alerts, which can be a great way for traders to stay up-to-date on market events.

Overall, XM's trading platforms are a valuable feature of the platform and offer a wide range of features and tools for traders.

Which XM platform is right for you?

The best trading platform will depend on your individual needs and preferences. If you are a beginner trader, MT4 is a good option because it is easy to use and has a wide range of features.

For more experienced traders, MT5 may be a better option because it offers more advanced features and tools.

If you want to trade from anywhere, XM WebTrader is a good option. And if you want to trade on your mobile device, the XM mobile app is a good option.

Ultimately, the best way to decide which platform is right for you is to try them all out and see which one you prefer.

XM Market Instruments

XM Broker offers a wide range of tradable instruments across multiple asset classes, including:

1️⃣ Forex (Foreign Exchange):

- Major currency pairs: For example, EUR/USD, GBP/USD, USD/JPY.

- Minor currency pairs: Such as AUD/CAD, NZD/JPY, EUR/GBP.

- Exotic currency pairs: Like USD/ZAR, GBP/NOK, EUR/TRY.

2️⃣ Commodities:

- Precious metals: Gold, silver, platinum, palladium.

- Energy commodities: Crude oil, natural gas.

- Agricultural commodities: Corn, wheat, soybeans, cocoa, coffee.

3️⃣ Stock CFDs (Contracts for Difference):

- Stocks from various international exchanges, including the US, UK, Germany, France, Japan, and more.

- Examples of popular stocks: Apple, Google, Amazon, Microsoft, BMW, and Toyota.

4️⃣ Equity Indices:

- Major global stock indices: S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, DAX 30, CAC 40, Nikkei 225.

- Regional indices: Euro Stoxx 50, IBEX 35, Shanghai Composite, Hang Seng.

5️⃣ Cryptocurrencies:

- Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and more.

6️⃣ Turbo Stocks:

- Turbo Stocks are CFD products that have specific stocks as underlying and 200:1 leverage. The trading of Turbo Stocks begins at the start of the trading day of the underlying and ends at the end of the same day. This process then resumes the next day.

7️⃣ ETFs (Exchange-Traded Funds):

- Diverse ETFs that track various sectors, industries, or indices.

Please note that the availability of specific instruments may vary depending on your geographical region and regulatory restrictions. XM provides a comprehensive list of tradable instruments on its website, and you can explore the full range of offerings specific to your account once you sign in.

Overall, XM Broker provides traders with various financial instruments to trade across multiple asset classes. This diversity ensures traders have a range of trading opportunities to explore and diversify their portfolios.

Is XM forex legit?

We consider XM a legit broker to trade Forex, Cryptocurrency, Shares, and CFDs. It is regulated and licensed by several top-tier financial authorities including FCA, ASIC, and CySEC. Therefore, it is so secure and low-risk to trade.

Is XM a reliable broker?

XM Broker has a generally positive reputation in the online trading industry and is considered reliable by many traders. The broker has been operating for several years and is regulated by reputable financial authorities, which adds a level of credibility to its operations.

XM CopyTrading

XM copy trading (also called XM mirror trading) is a platform that allows traders of all experience levels to automatically copy or mirror the trades of successful investors, called signal providers, in real time.

This is an excellent option for novice traders who want to learn from more experienced traders, or for busy traders who don't have time to monitor markets constantly.

By carefully selecting and monitoring the performance of copied traders, followers can create a diversified portfolio and potentially achieve their investment objectives with XM social trading.

Followers will pay a portion of their profits to signal providers as payment for their services. This portion is calculated as a percentage and is clearly stated by the signal provider. A follower chooses a signal provider with the most favourable profit-share ratio.

Features Of XM Copytrading

- Seamless Replication of Trades

- Wide variety of signal providers

- Flexibility and Control with risk management tools

- Transparency and Real-Time Monitoring

- Allows followers to learn by seeing the performance of the strategy providers.

XM Broker Review: Customer Support

According to our XM broker review, XM.offers offer 24/5 hour live help by a professional Customer Support department. Support is provided in 27 languages making it very convenient for clients from all over the globe.

A comprehensive FAQ page provides you with guidance and answers at any time and within minutes. If you can't find answers on this FAQ page, you can contact XM.com via their email address or live chat.

XM Broker Review: Education

This XM Broker review found that the broker offers a wide range of educational resources to help traders improve their trading skills and knowledge. These resources are designed for traders of all levels, from beginners to advanced traders.

- Webinars: XM Group hosts live webinars conducted by market experts. These webinars cover topics such as technical analysis, trading strategies, and market news. Traders learn from expert traders and analysts and get valuable insights on market trends and trading techniques.

- Seminars: XM Global conducts educational seminars in various regions across the world. These seminars provide traders with the opportunity to learn from experts in a traditional classroom setting. Traders can learn from experienced traders, share trading ideas and strategies, and network with other traders.

- Trading Tutorials: The trading tutorials are a comprehensive guide to trading, covering topics like risk management, money management, trading psychology, and trading strategies. These tutorials are available in a variety of formats, including video, text, and images, making it easy for traders to learn at their own pace.

- Market Analysis: XM Broker provides traders with daily market analysis, including technical analysis and fundamental analysis reports. The analysis helps traders to make informed trading decisions, stay on top of market trends and events, and track the market movements of different assets.

- Glossary: The XM Broker glossary is a comprehensive collection of trading terms and definitions. It is an essential resource for beginners, ensuring they learn the key terms and concepts of trading.

All in all, XM Broker provides a wealth of educational resources to traders. These educational resources are invaluable for traders to develop and improve their trading skills and knowledge. By offering a variety of resources, XM Broker ensures that traders of all levels can benefit from these resources, no matter their learning style.

XM Broker Review: Awards

Additionally, third parties have shown their approval for XM through accolades and awards. XM segregates its wide array of awards into three main categories: Forex Services Awards, Forex Broker Awards, and Forex Platform Awards. Some of the recognitions that XM has earned in 2019 include:

- Best FX Service Provider awarded by City of London Wealth Management Awards 2022

- Best CFDs Broker in MENA Region awarded by Forex Expo Dubai 2022

- Global Forex Broker of the Year awarded by Global Forex Awards 2022 – Retail

- Best FX Broker Europe awarded by World Finance Forex Awards 2022

- Most Transparent Broker awarded by CFI.co 2022

- Best FX Broker Middle East awarded by World Finance Forex Awards 2022

- Most Trusted Asian Forex Broker awarded by Global Forex Awards

- Best Broker awarded by FinTech Age Awards

- Best Forex Trading Platform 2022 awarded by Online Money Awards 2022

- The Best Mobile App awarded by Financial Expo Egypt 2022

XM Pros and Cons

By analysing all the features of XM and using the broker for over 5 yeards, we have found a number of common advantages and disadvantages that we would like to show you.

Pros

- MetaTrader 4 and 5 in all versions: XM provides its clients with the possibility to trade with any of the known variants of the MT4 and MT5 platform, either for PC with Windows or Mac operating systems, mobile devices with Android or iOs operating systems, as well as their corresponding web versions through its WebTerminal.This ensures that you are not trading with a makeshift platform by any means, but with robust trading terminals loved by most traders.

- Spreads of less than 1 pip for a large number of instruments: Undoubtedly many clients opt for brokers that offer low trading commissions as is the case with the spreads at XM, which can be considered significantly low for many of the financial assets on which it allows trading.It is worth noting that spreads are variable and may be subject to increases from time to time depending on market conditions and volatility.

- Multiple currencies as the base currency of the account:

XM forex group clients have the flexibility to select from a wide range of currencies for our account. XM offers a selection of base currencies including USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, and ZAR, except for XM Zero accounts which are limited to USD, EUR, and JPY. This arrangement reduces currency exchange fees during trading, resulting in cost savings for these transactions.

- No extra fees: With the exception of the XM Zero accounts which are subject to trading fees once a certain trading volume is reached, the most popular accounts, either the Micro account or the Standard account, are free of fees, not counting of course those charged for price difference when opening a position (spread).

- Considerably low minimum deposit: With as little as $5 or its equivalent, you can open an account of any type with the XM broker, be it Standard, Micro, or even the XM Zero account.

Cons

- No cryptocurrency trading in Europe: XM does not allow cryptocurrencies to be traded in the European region, which is undoubtedly a sought-after asset for most investors.

- Small number of tradable cryptocurrencies: XM allows trading with only 5 types of cryptocurrencies in accounts whose region includes this type of assets, a relatively low number for these times when these types of assets are so popular.

All in all, XM is a reliable broker that offers many advantages to Zimbabwean traders. It is one of the top five forex brokers for traders in the country.

FAQs On XM Broker Review

yes, Xm is a trusted broker that is regulated and has won many awards for great customer service

Their withdrawal requests are processed by the back office within 24 hours. You will receive your money on the same day for payments made via e-wallet, while for payments by bank wire or credit/debit card it usually takes 2 – 5 business days

The minimum deposit on XM is $5

XM does not charge anything for withdrawals

XM is an online trading platform that offers a wide range of financial instruments to its clients. The platform has been in operation since 2009 and has built a reputation for providing a safe and secure trading environment.

Yes, XM is regulated by several reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

XM offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies.

XM offers several trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The platform also offers its own proprietary platform called XM WebTrader.

XM offers several account types to suit the needs of different traders, including Micro, Standard, XM Zero, and Islamic accounts.

XM offers several bonuses and promotions to its clients, including the $30 no deposit bonus for new clients, deposit bonuses, and a loyalty program.

Yes, XM offers a range of educational resources to help clients improve their trading skills, including webinars, video tutorials, and a range of educational articles and guides. You can access them here.

The maximum leverage offered by XM is 1:888 for Micro and Standard accounts, 1:500 for XM Zero accounts, and 1:200 for Islamic accounts.

XM offers a wide range of deposit and withdrawal methods, including credit/debit cards, bank wire transfers, and e-wallets such as Neteller, Skrill, and WebMoney.

Yes, XM is a great platform for beginners because it offers a wide range of educational resources and a user-friendly interface. The platform also offers a $30 no deposit bonus for new clients, which can be a great way for beginners to get started with trading.

XM does not charge any fees or commissions on trades. However, clients should be aware of the spread, which is the difference between the buy and sell price of a financial instrument.

The Best Forex Brokers For You

Best for synthetic indices

- Trade 24/7 incl weekends

- $5 minimum deposit

- Fund with Ecocash, Zipit etc

Best for currencies

- $5 Minimum deposit

- Low spreads

- Variety of trading accounts offered

Other Posts You May Be Interested In

Learn The Effective 123 Pattern Reversal Trading Strategy

The 123 pattern reversal trading strategy begins by identifying three main points. For example, in [...]

How To Open A Deriv Currency Account 📈 In 5 Easy Steps

Deriv is popular for its synthetic indices like V75, Step Index, Boom & Crash Indices. [...]

How Does Deriv DP2P Work: 👉 A Step-By-Step Guide

What Is Deriv Peer-To-Peer DP2P? The Deriv peer-to-peer (DP2P) is a platform that provides Deriv traders with [...]

How To Trade Without Verifying Your Account: Quick & Easy Ways For Zimbabweans in 2022

This article will show you how to trade without verifying your account. Forex brokers ask [...]

Brokers Offering Copy Trading & Social Trading To Zimbabweans

What is Forex Copytrading? Copy trading allows traders to copy trades executed by other investors [...]

XM $30 No Deposit Bonus: All you Need To Know (2024) 💰

XM is offering a $30 No Deposit Bonus to new traders, allowing them to try [...]