The Best Forex Brokers For You

Best for synthetic indices

- Trade 24/7 incl weekends

- $5 minimum deposit

- Fund with Ecocash, Zipit etc

Best for currencies

- $5 Minimum deposit

- Low spreads

- Variety of trading accounts offered

What Is Deriv Peer-To-Peer DP2P?

The Deriv peer-to-peer (DP2P) is a platform that provides Deriv traders with an easy way to make deposits and withdrawals into and from their forex and binary trading accounts. The platform allows traders to exchange Deriv credits using local payment methods like EcoCash, Mpesa, cash or bank transfers.

The platform was developed as an alternative after Skrill closed its accounts for users in some countries like Zimbabwe and Togo. Skrill was popular amongst many forex traders and they were using it to fund and withdraw from their Deriv accounts.

Another option for moving funds into and out of your trading accounts on Deriv is the use of local payment agents.

How Does Deriv DP2P Work?

Deriv Peer-To-Peer allows traders (peers) to exchange Deriv credits. This is how it works.

Let's suppose trader 1 (Jonh) has made profits whilst trading forex, synthetic indices or boom and crash on Deriv and they now want to withdraw. They will go on DP2P and post an ad ‘selling' Deriv credit for EcoCash.

Trader 2 (Sam) wants to fund her account but she has EcoCash which is not accepted as a deposit method by Deriv. So she will go DP2P and ‘book' the Deriv credit that Farai is selling.

She will get Jonh's contact details from the ad and then get in touch.

Sam will then transfer EcoCash to Farai. Jonh will confirm payment and release the funds which will immediately reflect in Sam's Deriv account and she will start trading.

The whole transaction can take less than 10 minutes on dp2p Deriv making it very convinient.

Read: HOW TO TRADE SYNTHETIC INDICES: A COMPREHENSIVE GUIDE

How Do You Register On Deriv DP2P?

Follow the following steps to do DP2P Deriv sign-up.

Log in to your Deriv account. If you do not have an account you can create one for free first by clicking here (make sure you use the same name on your identity document for registration). If you need more instructions on how you can open a Deriv account you can read this article.

Log in to your Deriv account. If you do not have an account you can create one for free first by clicking here (make sure you use the same name on your identity document for registration). If you need more instructions on how you can open a Deriv account you can read this article.- Go to Cashier > Deriv DP2P & register.

- Choose a nickname that will be displayed to other users when you are buying and selling credits.

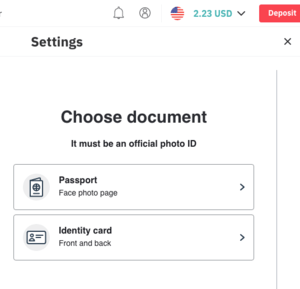

- Upload your identity documents so that Deriv can verify your identity. This is done to protect you and other users on the platform. You can upload either a Passport or an Identity document.

Make sure you have registered your account using the same name that is on your identity documents for easy identity verification

How Do You log in to Deriv DP2P?

You can log in to dp2p via the Deriv website or on the dedicated dp2p Deriv app.

To do dp2p login on the Deriv website simply log in to your Deriv account and click on Cashier > DP2P. You will then be logged in to dp2p and you can create buy or sell orders.

To log in to dp2p on the app simply enter the email address and password that you use for your main Deriv account. You will then see a screen like the one below.

Advantages of Deriv DP2P Over Skrill

-

Deriv DP2P Transfers are Instant, Withdrawals To Skrill Take Up To 48 hours

The funds are transferred instantly from one account to the other once a seller has confirmed receipt of payment on DP2P Deriv. With Skrill withdrawals, on the other hand, you need to first put in a withdrawal request and this request takes up to 48 hours to be processed.

In other words, you probably won't get your money withdrawn via Skrill on the same day, but you get it instantly via Deriv DP2P.

- DP2P Deriv Transfers Are Available 24/7 While Skrill Withdrawals Are Not Processed During The Weekend

The DP2P Deriv platform exchanges are available at any time as long as there are buyers and sellers. Skrill withdrawals are not processed over the weekend so if you make a withdrawal request late on Friday or during the weekend it will only be processed on Monday.

This makes it very inconvenient for traders.

-

Flexible Commission Rates On DP2P Deriv While Skrill Has Fixed Charges

You voluntarily choose the rate you want to buy Deriv credits for on DP2P from the range of sellers with ads on the platform. This means you choose the rates that are favourable to you. With Skrill, on the other hand, the fees are fixed and you cannot do anything about it.

- There Are Fewer Chances Of Being Scammed On Deriv DP2P Than When Using Skrill

A lot of traders have been scammed via Skrill when they wanted to fund their accounts. They would send mobile money to someone claiming to be selling Skrill and then this person would block them. In such cases, it was almost impossible to recover the funds.

With DP2P however, it is easier to track the person selling or buying Deriv credits. If you have been scammed you can raise a dispute.

For example, Deriv blocks the ordered Deriv credits for a maximum of 30 days if the buyer confirms payment but the seller does not confirm receiving payment and the exchange expires.

There is also a chat feature that you can use to keep track of your communication with the other party on DP2P and you can use this as evidence in case of a dispute.

All these factors make the platform more secure than using Skrill.

How To Avoid Being Scammed On Deriv DP2P

Having said the above, there are certain steps that you can take to further reduce the chances of being scammed on Dp2p. The tips below will assume that you want to buy Deriv credits and you will be using your local payment method to pay the seller

1. Make sure before sending the payment (mobile money or bank transfer etc) the Seller has put up an ad and you have booked it.

What is Booking on Deriv DP2P?

Booking is when the seller has put up an ad and the buyer clicks on the ad pending the making of the payment. The ad will then disappear from the main ad list.

The funds will be removed from the seller's account pending the confirmation of payment from the seller. If you don't book the funds the seller can easily resell them to someone else even after you have sent payment.

2. Always check the ratings and completion rate and time of the individual you are dealing with

3. Make use of the chat feature on the platform for record purposes. This will come in handy in the event of a dispute. WhatsApp chats will not be as effective.

4. Screenshot and keep the proof of payment message you get. This will help should the seller claim not to have received the funds.

5. Be a good sport and make payment as soon as possible after booking so as not to inconvenience the seller.

6. Leave good ratings and recommendations for good trade partners to help others choose them in the future.

FAQs On Deriv DP2P

The Deriv peer-to-peer (DP2P) is a platform that provides Deriv traders with an easy way to make deposits and withdrawals into and from their forex and binary trading accounts.

Dp2p is an innovative peer-to-peer deposit and withdrawal service by Deriv. With DP2P, you swiftly move funds in and out of your Deriv account by exchanging your local currency with fellow traders.

Dp2p works by allowing traders to exchange Deriv credits for local currency.

Simply contact Deriv live chat and they will increase your dp2p daily limit.

If you have been scammed on Deriv peer-to-peer you can complain by clicking on the ”Complain” button that appears after the order has expired. You can also email complaints@deriv.com

Simply upload your identity and proof of residence documents and your Deriv peer-to-peer account will be verified.

Deriv dp2p is the fastest way to withdraw from Deriv. You can complete your withdrawal in ten minutes or less

Other Posts You May Be Interested In

The Best Forex Brokers With No Deposit Bonus Offers (2024) 💰

Are you interested in trading forex but hesitant to risk your own money? Look no [...]

Brokers Offering Copy Trading & Social Trading To Zimbabweans

What is Forex Copytrading? Copy trading allows traders to copy trades executed by other investors [...]

How Does Deriv DP2P Work: 👉 A Step-By-Step Guide

What Is Deriv Peer-To-Peer DP2P? The Deriv peer-to-peer (DP2P) is a platform that provides Deriv traders with [...]

XM $30 No Deposit Bonus: All you Need To Know (2024) 💰

XM is offering a $30 No Deposit Bonus to new traders, allowing them to try [...]

The Effective Pinnochio Strategy For Trading Reversals (75%)

The Pinocchio strategy is a specific type of candlestick pattern, with candles that have oversized [...]

The Simple Double Red Strategy for Binary Options

Double Red Strategy The double red strategy is a binary options trading strategy that aims [...]